Innovating A Lot, Building Nothing: September Newsletter

Tracking the changes and changemakers behind the next great wave of disruption.

This Week in Disruption 2.0

You're Innovating a Lot - But You're Not Building Anything

Damodaran, Deutsche Bank, Decline and Disruption

ROI is the First, Second and Third Rule of Innovation

Never Mistake Punditry for Analysis (Wall Street Edition)

Never Mistake a Pundit for a Practitioner (Intrapreneur Edition)

But first, a word from our sponsors:

Check out the new book from Rick Powers, Founding Partner of Maybe Capital, "Buddhism For VC Billionaires: Notes from the World's #1 Competitive Buddhist." In this explosive tell-all, Powers shares how asceticism has transformed him into one of Silicon Valley's most powerful VCs. Avoid FOMO, use promo code PUNK to pre-order now.

Now, on with the show….

This Week in Disruption 2.0

Corporate executives are launching startups to disrupt industries that have been immune to disruption. My newsletter tracks this megatrend in real time.

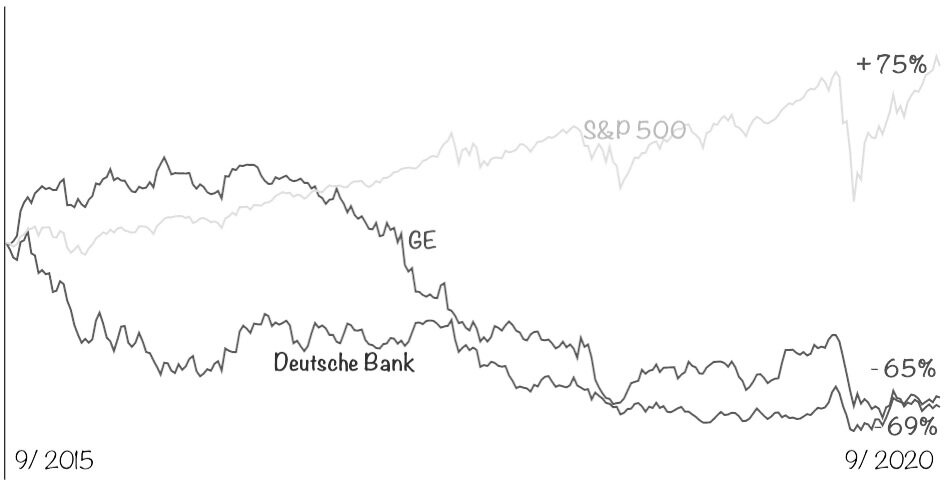

All the Way Down: GE and Deutsche Bank have declined by 65% and 69% over the last 5 years. By comparison, the S&P 500 has increased by 75%. Source: Yahoo Finance

You're Innovating A Lot, But You're Not Building Anything - The reason interpreneurship is important is because customers and investors don't like spending money on stupid shit. If customers feel like they're being ripped off, or investors don't see the returns they expect, then they leave.

Innovation, when it's done right, gives customers and investors a reason to fall back in love with a company which hasn't done much for them lately. Innovation, when it's done wrong, celebrates technology, but does nothing to drive loyalty, growth or efficiency.

For a long time I suspected that GE, despite its affiliation with two of the biggest, smartest names in innovation, Eric Ries and Beth Comstock, despite its emphatic embrace of lean and agile, was doing innovation wrong. I kept waiting for something to pop: a breakout new venture, the robust turnaround of a legacy business unit, something. While I was waiting, the company's stock dropped 66% to $6.31 a share from its 2017 high of $31 a share.

Thomas Gryta's new book, "Lights Out: Pride, Delusion, and the Fall of General Electric" is a brilliant deep dive into the perils of 'innovation theater.' In fact, what Gryta unmasks inside of GE goes beyond innovation theater, it's innovation malpractice. The company was dazzled by innovation's sparkly lights without ever using it to reverse its slide from maturity into decline. The culture was so heirarchical, and the process so dogmatic that the entire firm innovated a lot without building anything. It's a great book, and a badly needed cautionary tale.

Damodaran, Deutsche Bank, Decline and Disruption: The demise of GE has been mirrored across the Atlantic, by the demise of the once venerable Deutsche Bank. Both companies were once icons of precision and scale. There are huge differences between GE and Deutsche Bank, and I don't want to conflate the two businesses. But what ties them together is that neither is an anomaly.

Disruption emerges when a mature industry transitions into decline. When a once unassailable incumbent fades, entrepreneurs fill the vacuum that they leave behind. Customers and investors who were once evangelical loyalists become willing to listen to the young, hungry new entrant who believes that they can serve them better, faster, smarter and cheaper. Those same investors and customers start to suspect that every other company which looks like the fallen heavyweight is bloated and ick with the same disease.

Right now, as I sit at my kitchen table writing this newsletter, is that moment. The decline of GE and Deutsche Bank has created a vacuum that will be filled by a new entrant. Industrial conglomerates, commercial banks and investment banks were mistakenly assumed to be too capital intensive for a lean startup to move in and make a dent. But there's a difference between capital intensive and bloated. The automotive industry was also assumed to be undisruptable. Then Tesla changed the script.

In a previous post I mentioned some of the startups that are trying to fill this vacuum. One of them will emerge as the world's next Amazon or Google.

ROI is the first, second and third rule of innovation - Innovation must be accountable for delivering a return on investment. Yes, a single product or new venture must have permission to fall, but at the portfolio level, intrpreneurs must satisfy the need of investors and customers. Intrapreneurs have to increase profits on old businesses, generate new growth, and launch a portfolio of new ventures which generates breakout growth.

GE never passed this test. But David Binetti did!

David Binetti's innovation options model is genius. He has taken a Wall Street tool that enables an investor to wait and see if they want to buy a stock while they gather more information (an option) and repurposed it for evaluating the performance of new incubated ventures inside a huge company. It's brilliant. The innovation options model is a way of evaluating the performance of a new venture that has no track record of performance. Here's an extremely clear and simple clip of him explaining innovation options at the Lean Startup Conference. (We spoke on the phone and he's also a nice, funny, interesting man. A mensch, as my people would say).

His writing on innovation options reignited my love of finance. I disliked the culture of Wall Street, but I've always loved the puzzle of capital markets. I'm currently writing a deep dive manual for measuring ROI across an innovation portfolio that will be published on September 9 (Innovation Options, is one of the tools). The current working title is, "What's my Trade, Asshole?" You'll love it - and with a name like that you won't be able to miss it.

If you're a valuation expert or aficionado, reach out to me if you want to collaborate with me on my next post.

Never Mistake Punditry for Analysis (Wall Street Edition) - Markets crash when novices who have 10% fluency invest with 100% confidence. Options, the same instrument that David Binetti (who has fluency) describes, were also responsible for the suicide of Alexander Kearns, a 20-year old hobbyist investor who was trading options on the Robinhood app. The world of investing is dangerously dominated by pundits pretending to be analysts. In the same way that an inspiring TED talk by a cardiologist should not embolden anyone to perform triple bypass surgery; a pundit screaming into a TV camera about their stock picks should not embolden anyone to start trading stocks. So, I was rattled by the death of Alexander Kearns. The same design principles which make people addicted to Facebook, Instagram, and Fortnite are now being used to lure teenagers into financial instruments that Warren Buffet (another actual expert) described as "financial weapons of mass destruction." It's dangerous and I expect that it will drive legislation in Congress if it continues.

Never Mistake a Pundit for a Practitioner (Intrapreneur Edition) - The people who spend their careers generating new growth in old companies have totally different innovation insights than the pundits who talk about innovation on stage.

Which brings me to Simon Sinek. His new talk, "Innovation Shouldn't Be Efficient" struck a 'this is total bullshit' chord with me. My experience is that innovation ONLY works if the company needs it to generate efficient ROI. If companies don't depend on innovation to generate growth then everyone fails. Otherwise, it lives in the soul-sucking purgatory of a cost center, where it pulls from the same budget as the office Christmas Party.

If you follow his advice, and don't insist on ROI, you risk ending up looking like GE.

News From the Entrepreneur Exodus

Do you have a story about the entrepreneur exodus (fundraising, new hires or departures, cool product launches, etc.)? Submit to nicole@punksandpinstripes.

Hiring Punks & Pinstripes

Fractal, a technology innovation agency, is searching for senior engineers and consultants to join their team. Send us a note for more information.

I'll Try Not to Break Anything... Upcoming Appearances and Events

I'll be speaking at BraveIT's Tech 2025 News Roundtable on Thursday, September 17th. The panel will go live at 12:45PM ET. More info and sign up here.

On October 15th at 10AM I'll be joining Siemens for a talk on Intrapreneurship in the New Age of Disruption. Stay tuned for more info.

I'll be leading the American Advertising Federation of Greater Evansville in a deep dive into the next great wave of disruption on October 22. Stay tuned for more info.

Interested in booking me to speak at your next event? Send us an email at nicole@punksandpinstripes.com.